WHAT WE DO

Indices Trading

Navigating the Intricacies and Strategies of Indices Trading for Informed Financial Decision-Making

- Predicting Market Segments

- Mechanics of Index Calculation

- Diverse Index Weighting Methods

- Influential Factors in Index Prices

Indices trading involves predicting price fluctuations in a group of stocks or securities representing a specific market segment or industry using financial derivatives like CFDs, futures, or ETFs.

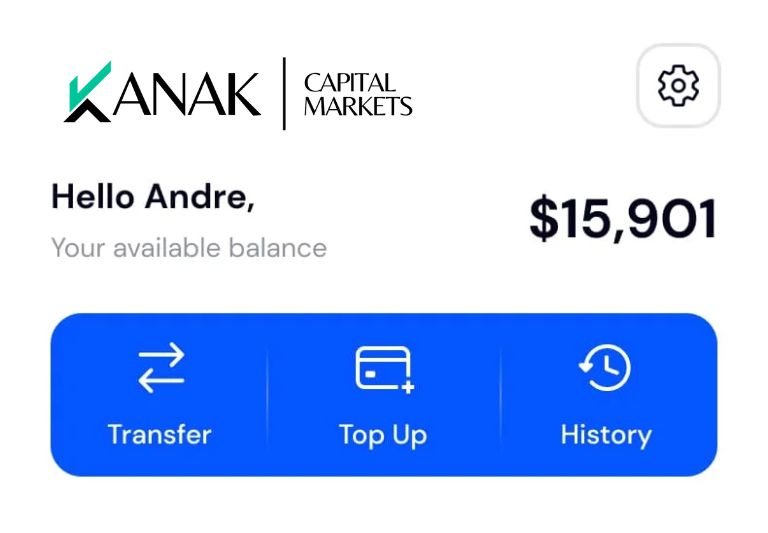

ACHIEVE MORE

Why Choose Indices Trading?

Why Choose Indices Trading?

Diversification

Indices trading allows you to diversify your portfolio by gaining exposure to a broad range of stocks, reducing risk compared to individual stock trading.

Liquidity and Flexibility

Indices trading offers high liquidity, ensuring you can easily enter and exit positions, along with flexibility to choose from various trading instruments.

Efficient Market Analysis

Indices serve as barometers of market sentiment, providing a holistic view of market trends, making it easier to analyze and make informed decisions.

Cost-Effective

Trading indices often involves lower costs compared to buying individual stocks, making it an economical option for both novice and experienced traders.

WHAT IS IT

What is Index Trading

Indices trading or Index trading is a popular way for traders to gain exposure to financial markets without directly investing in individual company stocks, bonds, commodities, or other assets.

People new to financial markets start with index trading, meaning they trade an index-tracking fund or basket of shares instead of buying and selling individual company stocks.

When tracking the performance of a large group of shares, a stock index aims to reflect the state of a broader market, for example, the stock market of a country or a specific sector. This means that there is a tendency to be diversified.

KNOW HOW

How To Identify What Moves An Index’s Price?

A range of factors can affect the price of an index, including:

HOW IT WORKS

Deciphering the Calculations Behind Stock Market Indices Trading

Stock market indices hold an intrinsic significance in the realm of finance, functioning as barometers that offer insights into the general well-being and performance of specific sectors or even the entirety of the market. These indices wield the power to shape traders’ and investors’ perceptions, serving as benchmarks that enable them to comprehend prevalent market trends and make prudent, well-informed decisions. But have you ever wondered about the mechanics underpinning the calculation of these pivotal indices?

In the forthcoming sections, we will embark on an intricate journey into the mechanics involved in the calculation of stock market indices trading.

Unraveling the Essence of Stock Market Indices

Before diving into the realm of calculations, it’s imperative to establish a firm grasp of the essence embodied by stock market indices. Essentially, a stock market index is a numerical metric that mirrors the value of a specific amalgamation of stocks. This amalgamation can encompass a diverse array of sectors, industries, or even the entirety of the stock market itself. As an exemplification, consider the S&P 500 index, a representative ensemble of the 500 largest publicly traded companies within the United States.

The Weighty Role of Market Capitalization in Indices Calculations

A prevalent method underpinning indices calculations is market capitalization weighting. Under this methodology, the value of the index is contingent upon the aggregate market value of the constituent stocks. The larger a company’s market capitalization, the more pronounced its influence on the overall index value. This methodology aptly encapsulates the relative magnitude of each company within the index.

The Intricacies of Market Capitalization Calculation

The journey of indices calculation commences with the calculation of market capitalization for each constituent stock. This involves multiplying the current stock price by the total number of outstanding shares, thereby bestowing insight into the aggregate market value of each stock.

The Alchemy of Weight Calculation

Following the determination of market capitalization, the weight of each stock is ascertained. This is achieved by dividing the market capitalization of each stock by the total market capitalization of all stocks within the index. This step lays the foundation for attributing significance to each stock’s contribution to the index.

The Unveiling of Index Value Calculation

The culmination of the calculation process involves the derivation of the index value itself. This entails the multiplication of a stock’s weight by its price. Summation of these products across all constituent stocks ultimately yields the final index value.

Peering Into Price Weighted Indices

Price weighting stands as another prevailing methodology in indices calculations. In this context, the value of the index is steered by the stock prices, diverging from the market capitalization-oriented approach. Consequently, stocks boasting higher prices wield a more pronounced impact on the index value.

Navigating the Process of Price Weighted Indices Calculation

The initial stride in the realm of price weighted indices calculation is the summation of the prices of all constituent stocks within the index. This summation subsequently undergoes division by a predetermined divisor, a value subject to periodic adjustments aimed at preserving index continuity. This division begets the culminating index value, encapsulating the essence of the constituent stock prices.

The Equitable Terrain of Equal Weighted Indices

Conversely, equal weighted indices embrace a different perspective. In this landscape, every stock within the index carries equal weight, regardless of the discernible market capitalization or stock price. This methodology is grounded in the aspiration to proffer an inclusive representation of the index, ensuring that the impact of smaller companies mirrors that of their larger counterparts.

Embarking Upon the Voyage of Equal Weighted Indices

Calculation The voyage of equal weighted indices calculation commences with the equitable attribution of uniform weight to all constituent stocks. The final index value is fashioned through the summation of prices across all constituent stocks, subsequently undergoing division by the total number of stocks within the index.

Investments

Subscribers

Years of Trusted Service

TESTIMONIALS

What people say about us

Kanak Capital Markets has helped me significantly grow my portfolio. I trust their expertise for my investments

Mike Taylor

Exceptional service at Kanak Capital Markets! I’ve earned over $10,000 in profit since joining. Highly recommend to fellow investors.

Chris Harsh

With a decade of expertise, Kanak Capital Markets consistently delivers results. Proud to be part of their 100% satisfied user base.