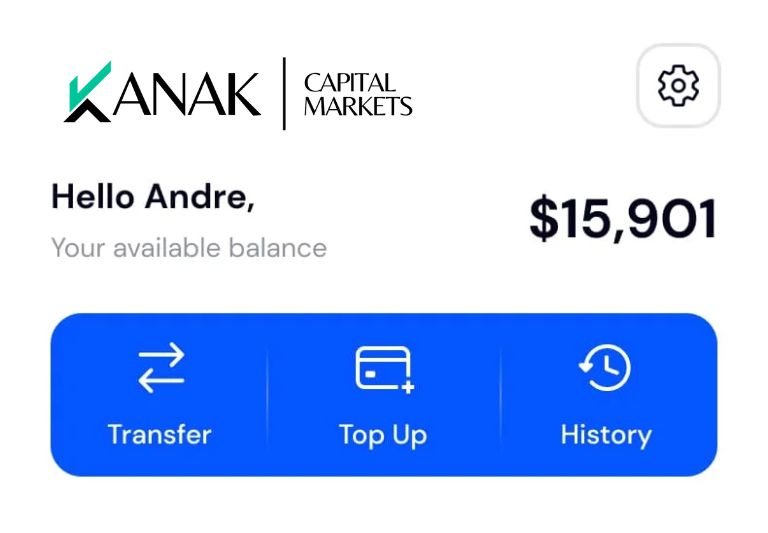

WHAT WE DO

Forex Trading

Capture Global Markets and Maximize Returns through Forex Trading

- Diverse trading strategies.

- Leverage for Risk and Reward

- High Liquidity, Always Open

- The Global Trading Center

Forex trading, or foreign exchange trading, is the act of buying and selling currencies in the global financial market to profit from exchange rate fluctuations and currency value changes.

ACHIEVE MORE

Why Choose Forex Trading?

Global Currency Market

Forex trading involves the buying and selling of currencies from around the world, making it the largest financial market globally.

24/5 Accessibility

Forex operates 24 hours a day, five days a week, allowing traders to engage in activities at their convenience across different time zones.

High Liquidity

Forex offers high liquidity, ensuring traders can enter and exit positions easily, even in large volumes, without significant price fluctuations.

Leverage

Forex allows traders to use leverage, which amplifies potential profits but proper risk management is essential.

WHAT IS IT

What is Forex Trading?

Forex trading, short for foreign exchange trading, is the process of buying and selling currencies in the foreign exchange market.

It involves trading one currency for another with the aim of profiting from fluctuations in exchange rates. Forex is the largest and most liquid financial market in the world, where participants, including banks, financial institutions, corporations, and individual traders, engage in currency exchange transactions.

Traders speculate on the rise or fall of one currency’s value relative to another and seek to capitalize on these price movements to make a profit.

HOW IT WORKS

Forex Trading & Its Advantages

Forex (FX) is a portmanteau of foreign currency and exchange. The process of foreign exchange involves the conversion of one currency into another for a variety of reasons, usually to facilitate commerce, trade, or tourism.

Trading forex has many advantages, including the possibility of trading on leverage, strong liquidity, and the ability to trade around the hours from Sunday to Friday.

Leverage

Leverage is a major characteristic of foreign exchange, and it implies that you only need a small initial deposit, or margin, to make a deal.

Margined trading is a more efficient use of money since you just have to supply a fraction of the whole value of your position while keeping full market exposure. This simply implies that if the market goes in your favor, you enhance your profit potential while decreasing your loss possibility.

Remember that higher leverage increases both losses and earnings. Furthermore, markets might move against you, and your losses may surpass your initial payment due to continuous price movement.

24-Hour Market

Forex is an over-the-counter (OTC) market, which implies that deals do not take place on a centralized exchange, such as shares or indices. From Sunday night through Friday night, FX trading takes place around the world, around the clock.

This indicates that, unlike standard financial markets, investors may nearly always respond to currency movements caused by economic, political, and social events as they arise, instead of waiting for markets to open.

FX markets provide price volatility 24 hours a day, so whatever your trading method, there are various trading opportunities available. This also implies that the markets are continuously changing, emphasizing the importance of carefully monitoring your positions and implementing suitable risk management methods.

High Liquidity

Since the forex market is so large, it is also very liquid. This is good because it means that when the market is normal, you can buy and sell whenever you want with the click of a mouse.

You’re never “trapped” in a deal. You can even set up your online trading platform to close your position automatically if you reach your profit goal (with a limit order) or cancel a trade if it is losing money (with a stop-loss order).

Because of this, prices are often easier to use, and, unlike in other financial markets, traders can almost instantly respond to changes in the currency market 24 hours a day, five days a week.

Investments

Subscribers

Years of Trusted Service

TESTIMONIALS

What people say about us

Kanak Capital Markets has helped me significantly grow my portfolio. I trust their expertise for my investments

Mike Taylor

Exceptional service at Kanak Capital Markets! I’ve earned over $10,000 in profit since joining. Highly recommend to fellow investors.

Chris Harsh

With a decade of expertise, Kanak Capital Markets consistently delivers results. Proud to be part of their 100% satisfied user base.