Live Market Updates

Microsoft Corp. (MSFT)

Get real-time stock updates and comprehensive market analysis for one of the world's most valuable companies.

Want to invest in MSFT Stocks?

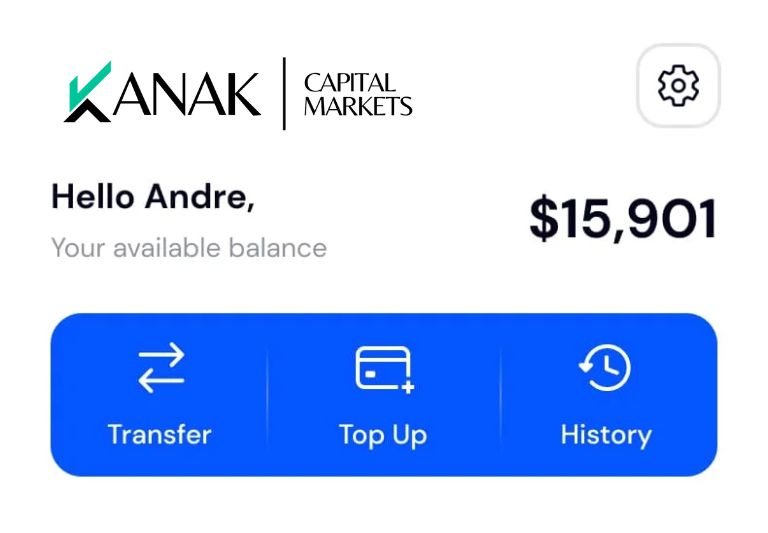

Trade smarter with Kanak Capital Markets -your gateway to global markets. From stocks to energy, access powerful tools on a secure, easy-to-use platform. Sign up now and take control of your investments.

Company Profile

About Microsoft Corporation

Microsoft stock (MSFT) is a key player in the global technology market, known for its leadership in software, cloud computing, and artificial intelligence. As of April 2025, the Microsoft stock price today is around $391, reflecting its strong market position and investor confidence. With a market capitalization of approximately $2.9 trillion, Microsoft continues to dominate with products like Windows, Microsoft 365, and its rapidly growing Azure cloud platform, making the Microsoft share price a favorite among traders and investors alike.

The company’s consistent innovation and robust financial performance have helped Microsoft stock maintain steady growth, supported by expanding AI capabilities and enterprise solutions. Whether you’re tracking the Microsoft stock price for short-term trading or long-term investment, Microsoft’s diversified business model and strong earnings outlook make it a compelling stock to watch in 2025 and beyond.

Stock Price Range

$344.79 - $514.64

Average Daily Volume

18.5M Shares

PE Ratio (TTM)

39.60

EPS (TTM)

12.9

Dividend Yield

0.60%

Market Share

23% global cloud infrastructure

More on Microsoft Corporation

Microsoft stock in focus – Deep Dive into Market Strength and Stock Potential

Microsoft’s stock is highly valued due to its strong brand, diversified revenue streams, leadership in cloud computing, and its dominance across multiple tech sectors. With a rapidly growing AI business and a cloud platform that fuels millions of enterprises worldwide, Microsoft is not just evolving – it’s shaping how businesses and individuals operate in 2025 and beyond.

For traders, this means exposure to a company that combines innovation, scale, and consistent financial strength, making it a key player in the global stock markets. Below is a detailed breakdown to help you understand Microsoft as an investment opportunity:

Brand Value

Microsoft is the third most valuable brand globally, with a 2025 valuation of $501.8 billion. Its brand strength reflects trust, innovation, and a strong foothold in both consumer and enterprise markets.

Market Capitalization and Stock Metrics

- As of April 2025, Microsoft’s market capitalization is approximately $2.89 trillion, making it the second-largest publicly traded company after Apple Inc (AAPL).

- The stock’s 52-week price range is $344.79 to $468.35, showcasing significant investor interest and price stability.

- Microsoft’s earnings per share (EPS) for Q1 FY2025 was $3.30, reflecting strong profitability.

Revenue and Business Model

Microsoft reported fiscal year 2024 revenue of $245.1 billion. Its revenue streams are divided into three main segments:

- Productivity and Business Processes: Includes Office 365, LinkedIn, and Dynamics, contributing $29.4 billion in Q2 FY2025 (14% YoY growth).

- Intelligent Cloud: Includes Azure and server products, generating $25.5 billion in Q2 FY2025 (19% YoY growth).

- More Personal Computing: Covers Windows OS, Surface devices, Xbox gaming consoles, and advertising revenue, contributing $14.7 billion in Q2 FY202535.

Core Products

- Cloud Computing: Azure is a key growth driver with a 31% YoY increase in revenue for Q2 FY2025.

- Productivity Tools: Microsoft 365 (Office suite) remains a staple for businesses worldwide.

- AI Initiatives: Investments in OpenAI and tools like Microsoft Copilot are driving adoption of AI-powered solutions.

- Gaming: Xbox consoles and gaming services contribute to its consumer ecosystem.

- Hardware: Surface devices provide premium alternatives in the PC market.

Major competitors include:

- Cloud Computing: Amazon Web Services (AWS), Google Cloud Platform (GCP), IBM Cloud.

- Operating Systems: Apple macOS, Google Chrome OS.

- Productivity Software: Google Workspace.

- Hardware: Dell, HP, Lenovo.

- Gaming: Sony PlayStation, Nintendo.

Microsoft Stock Performance Overview

| Aspect | Details |

|---|---|

| Brand Value | $501.8 billion (2025), third most valuable globally |

| Market Cap | ~$2.89 trillion (April 2025) |

| Stock Price Range | $344.79 – $468.35 (52-week range) |

| Revenue Breakdown | FY2024 Revenue: $245.1 billion; Key segments include Productivity ($29.4B), Cloud ($25.5B) |

| EPS | $3.30 for Q1 FY2025 |

| Core Products | Azure Cloud, Microsoft 365, LinkedIn, Surface Devices, Xbox |

| Competitors | AWS, Google Cloud, Apple macOS, Google Workspace |

| AI Growth | Fastest-growing segment; Azure OpenAI usage doubled |

Microsoft’s strong financial performance, leadership in cloud computing and AI technologies, and diversified revenue streams make it an attractive investment option for traders seeking exposure to high-growth tech sectors. However, investors should also consider valuation metrics and market conditions before making decisions.

Kanak Capital Markets’ Take on Microsoft (MSFT) in the Stock Market

Microsoft stands tall as a global tech titan, driving innovation with its cutting-edge cloud services, AI advancements, and essential productivity tools used by millions worldwide. Even amid shifting market trends, Microsoft’s solid financial performance and diversified business segments make it a dependable choice for investors seeking both growth and stability.

For traders, MSFT represents more than just a stock-it’s a gateway to the future of technology and enterprise solutions. As the company pushes boundaries and expands its reach, Microsoft continues to offer exciting possibilities in the evolving market landscape.

Curious about how Microsoft stock fits into your trading strategy? Connect with our experts at Kanak Capital Markets to explore tailored insights and opportunities.

Sources

Disclaimer: This blog is for informational purposes only and does not constitute financial or investment advice. Data is sourced from what we believe to be reliable, but we do not guarantee its accuracy or completeness. Trading involves risk. Always do your own research, fact-check independently, and consult a certified advisor where needed. The content does not consider your specific financial situation or objectives. Kanak Capital Markets accepts no responsibility for any consequences arising from its use. For more info.

Start Your Trading Journey Now

Your questions answered

Common Questions

What is Microsoft’s market capitalization in 2025?

Microsoft’s market cap stands near $2.9 trillion in 2025, making it one of the world’s most valuable companies.

Can I buy Microsoft stock directly from the company?

No, Microsoft stock can only be purchased through a registered brokerage account, not directly from the company.

What is the Microsoft share price?

The Microsoft share price is $510.88 as of July 25, 2025.

How can I invest in Microsoft stock?

Open a brokerage account, search for the ticker symbol MSFT, and place your buy order for shares or fractional shares.

Is Microsoft stock a good investment?

Microsoft stock is favoured for its strong growth in cloud and AI, solid financials, and market leadership, but always do your own research before investing.

Who is the CEO of Microsoft?

Satya Nadella has been the CEO of Microsoft since 2014, driving the company’s focus on cloud and AI innovation.

What is Microsoft’s dividend yield?

Microsoft offers a dividend yield of around 0.85%, with a history of consistent dividend growth.

What was Microsoft’s stock performance over the last 10 years?

An investment of $10,000 in Microsoft stock 10 years ago would be worth over $80,000 today, reflecting strong long-term growth.

How Can I Trade CFDs on Microsoft Stocks?

To trade Microsoft CFDs, open an account on a regulated platform like Kanak Capital Markets. After funding your account, search for MSFT, choose your position size, and decide to buy or sell based on your strategy. We offer a secure, licensed environment with competitive spreads and risk management tools.