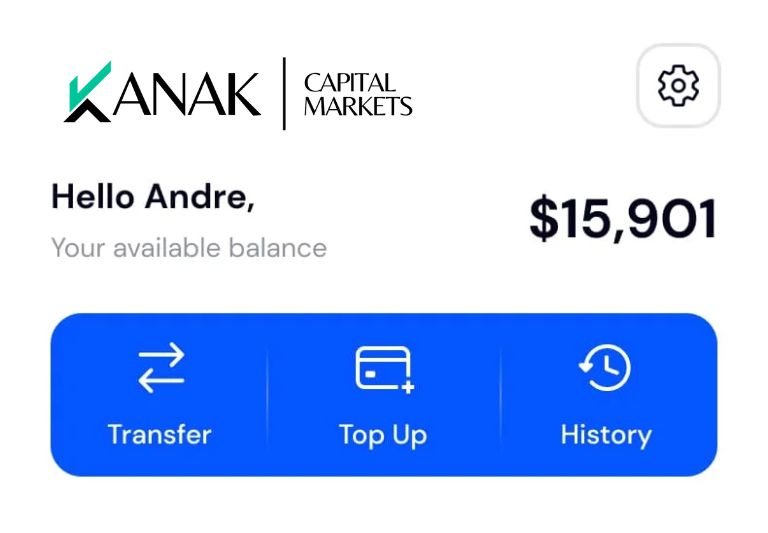

Best Platform For

CFD Trading

Cultivating Financial Success and Diverse Investment Opportunities through CFD Trading.

- Global Market Access

- Diverse Asset Classes

- Leveraged Trading

- Liquidity and Market Depth

CFD (Contract for Difference) trading is a financial derivative where traders speculate on the price movements of assets without owning them. It allows for potential profit or loss based on price changes.

ACHIEVE MORE

Why Choose CFD Trading?

Diversification

Use CFDs to diversify with currencies, commodities, indices, and cryptocurrencies, boosting your portfolio in dynamic markets.

Intraday Flexibility

CFD trading offers 24/7 flexibility to fit your schedule and seize market opportunities.

Short-Selling

Short-selling in CFD trading allows you to capitalize on decreasing asset prices, creating potential profit opportunities.

Risk Management

Use stop-loss orders in CFDs for safer trading by limiting potential losses automatically.

WHAT IS IT

What is CFD Trading?

CFD (Contract for Difference) trading is a financial derivative instrument that allows traders to speculate on the price movements of various assets, such as stocks, indices, commodities, and currencies, without owning the underlying assets. In a CFD trade, the investor agrees to exchange the difference in the asset’s price between the contract’s opening and closing, either profiting or incurring losses based on the direction of the price movement.

CFDs offer the advantage of leverage, enabling traders to amplify potential gains or losses, but they also involve significant risk. A reliable CFD trading platform provides the tools and flexibility needed to navigate volatile markets. CFD trading is popular for its ability to profit in both rising and falling market conditions.

KNOW HOW

Why Choose CFD Trading

Key Advantages of indices Trading with Kanak Capital Markets

HOW IT WORKS

How Does CFD Trading Work?

CFD trading does not possess the purchase or sale of the underlying investments (for example a physical share, currency pair, or commodity). You buy or sell a specific amount of units based on whether you believe prices will rise or fall.

CFDs are available on a broad number of worldwide markets, and Kanak Capital Markets CFD instruments include many options & opportunities for you to trade in.

Your profit is multiplied by the number of CFD units you bought or sold for every point the price of the instrument changes in your favor. You will lose one point for each point the price goes against you.

How to Trade CFDs?

A stock trading plan helps you to understand what caused past success and failure in order to better predict future outcomes. The three key factors that must be included are:

- Select the instrument you want to exchange.

CFDs can be traded on hundreds of instruments, including currencies, indices, commodities, stocks, and treasury. - Decide if you like to sell or buy.

Depending on whether you predict prices to climb or decrease, go long (buy a trade) or short (sell a trade). - Select your trade size.

The number of points the market moves in your favor or against you multiplied by the number of CFD units you have selected to trade determines your profit or loss. - Make your trade.

Manage your risk by including any stop-loss or confirmed stop-loss orders before finalizing your deal. - Keep track of your position.

From the position screen, you may track your CFD trade. You can exit if you want or partly shut a position at any moment.

Investments

Subscribers

Years of Trusted Service

TESTIMONIALS

What people say about us

Kanak Capital Markets has helped me significantly grow my portfolio. I trust their expertise for my investments

Mike Taylor

Exceptional service at Kanak Capital Markets! I’ve earned over $10,000 in profit since joining. Highly recommend to fellow investors.

Chris Harsh

With a decade of expertise, Kanak Capital Markets consistently delivers results. Proud to be part of their 100% satisfied user base.